New York – Sustainability issues are increasingly relevant to investors as they seek to integrate environmental and corporate responsibility factors in both current and future investment practices.

New York – Sustainability issues are increasingly relevant to investors as they seek to integrate environmental and corporate responsibility factors in both current and future investment practices.

New research released on May 22 by PwC US examines the influence sustainability issues have on investment decision-making, primarily among large institutions that provide considerable capital to finance growth for companies.

“The purpose of this survey was to gain a deeper understanding of whether sustainability issues are affecting the decisions being made by investors,” said Kayla Gillan, Leader of PwC’s Investor Resource Institute. “Our research sought to gain insight from investors about how they are incorporating issues of climate change, resource scarcity, extreme weather events and evolving corporate responsibility expectations into their investment decisions and strategies. We found significant evidence that an effect is occurring today – and that it is likely to increase in coming years,” Gillan added.

In this release, PwC identifies the types and sizes of institutional investors who are integrating these issues into their investment strategies or practices, and more specifically, how they are doing so. A diverse range of institutional investors responded, representing more than $7.6 trillion in total assets under management (AUM), broken down as follows: asset managers (45%), pension funds (33%), mutual funds (7%), hedge funds (5%) and a variety of other organizations (10%).

Key survey findings include:

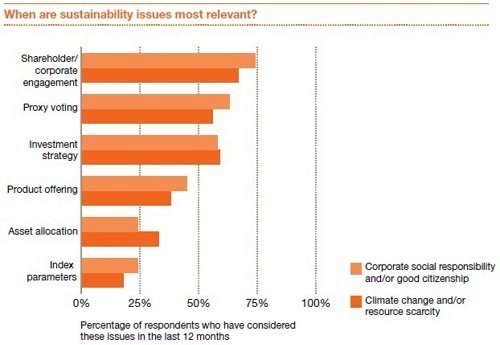

- Four of five investors consider sustainability issues to be relevant. About 80% of responding investors say that they considered these concepts in one or more investment contexts during the past year. The majority of these investors considered sustainability issues when they were voting proxies and deciding whether to engage directly with a portfolio company about a subject of concern – and this is particularly true when investors are considering matters of corporate social responsibility or good citizenship. Very large investors (that is, those with AUM of over $100 billion) are most likely to incorporate sustainability issues into their investment strategy.

- Sustainability is becoming increasingly relevant. PwC’s research found that most investors anticipate considering these concepts in at least some aspect of the investment decision-making process. In the last 12 months, 82% considered climate change and/or resource scarcity in future investment decisions, while 79% of investors considered social responsibility and/or good citizenship. These issues will continue to factor into investors’ future decision-making, with 87% expecting to consider climate change and/or resource scarcity over the next three years and 84% of investors expecting to do the same for social responsibility and/or good citizenship.

- Direct engagement likely to dominate the playbook. Most investors who identified sustainability issues as relevant say it is “very likely” they will have some form of direct communications with their portfolio companies about this topic in the next 12 months. Of these investors, nearly 90% indicate they will “very likely” just request information directly from the company. More than two-thirds of investors in this group are “very likely” to seek a meeting with the companies’ boards or management. Use of proxy – whether it is through shareholder proposals or “vote no” campaigns targeting company directors – is less likely.

- Reducing risk is top driving force. Nearly three-quarters of investors say the primary driver for considering sustainability issues is risk mitigation (73%). Enhancing performance returns (52%) and avoiding firms with unethical conduct (55%) rank as other key drivers.

- Common standards are needed. Two-thirds of investors say that if common standards were used, they would be more likely to assess the materiality of environmental or social factors when making investment decisions. With Europe being the exception, investors in both the U.S. and other regions around the globe are dissatisfied with current reporting.

- Demand for better information. Investors are significantly dissatisfied with the current level of transparency and reporting of sustainability information with respect to US-listed securities, according to PwC’s survey. This disparity is most pronounced in the context of risk and comparability: 82% of investors were dissatisfied with the financial quantification of risks and opportunities, with the comparability of information (79%) and relevance and implications of sustainability risks (74%) following close behind.