Since the adoption of the Kyoto Protocol in 1997, the establishment of a harmonised international carbon market has been seen as one of the main strategies in international climate policy. So far, however, the market is far from being globally harmonised or systematically linked. Instead, a mosaic of national and sub-national markets has been under development, differing in timing, location, relationship to the Protocol and their levels of legal commitment.

Since the adoption of the Kyoto Protocol in 1997, the establishment of a harmonised international carbon market has been seen as one of the main strategies in international climate policy. So far, however, the market is far from being globally harmonised or systematically linked. Instead, a mosaic of national and sub-national markets has been under development, differing in timing, location, relationship to the Protocol and their levels of legal commitment.

Designing a harmonised international carbon market is not only seen as a main strategy under the Kyoto Protocol, but also a key goal of the European Union.

In a recently published policy paper, Wolfgang Sterk and Florian Mersmann from Wuppertal Institute for Climate, Environment and Energy, Wuppertal, Germany, analyzed six developing countries with possible domestic emissions trading systems and the possibilities of linking them to existing trading systems like EU ETS (European Union Emissions Trading Schemes). In this article, the authors sum up their analyses for the readers of ThinktoSustain.com.

Even after Copenhagen, the European Commission had still optimistically assumed that an OECD-wide carbon market could be achieved by 2015 and that some advanced developing countries might be included as early as 2020. As plans for the establishment of emissions trading systems (ETS) emerge in various developing countries, prospects for linking them to existing systems seem to finally get in reach.

Links among ETS of every type of country will have to deal with seven basic issues: coverage of the scheme, definition and recognition of trading units, type and stringency of emission targets, allocation methodology, temporal flexibility, MRV (Measurement Reporting and Verification), and compliance systems. Each of these seven issues raises several challenges that policy makers have to solve in order to establish working systems.

Linking developed and developing country schemes raises another fundamental issue: Since developing countries do not dispose of Kyoto-valid trading units, new mechanisms or policy options need to be developed if trading units from developing countries are to be used by industrialised countries.

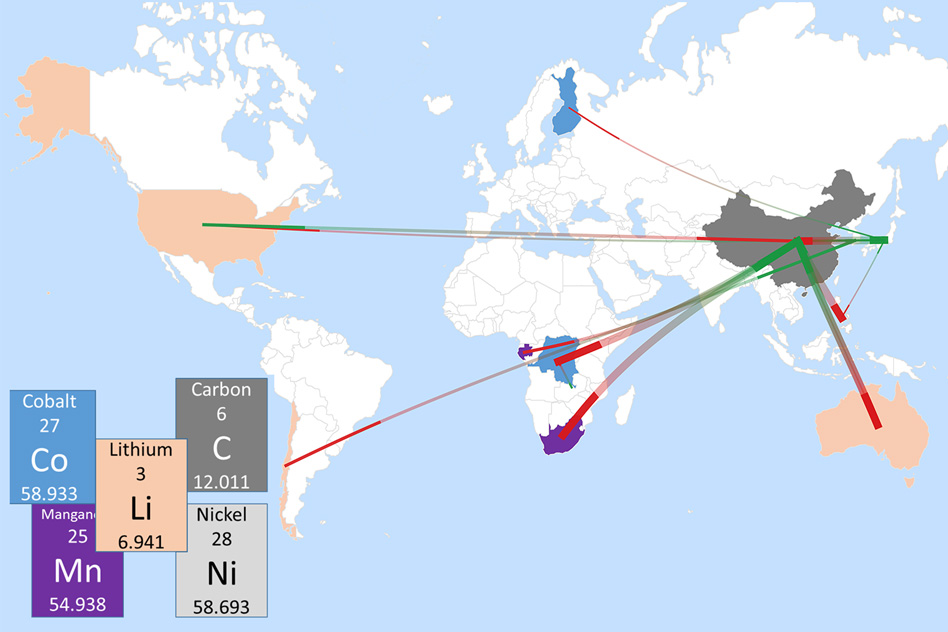

In the recent policy paper, “Domestic Emission Trading Systems in Developing Countries: State of Play and Future Prospects”, six developing countries with possible domestic ETS are analysed: Brazil, China, India, Kazakhstan, Mexico and South Korea.

Brazil has established a stock exchange for voluntary carbon units which may precede a domestic trading scheme. China has made concrete steps towards the creation of regional ETS in various cities and provinces. Newer announcements even envisage the creation of a national system by 2015. However, these plans are still in early stages, and differ widely in their institutional designs. India has not shown much propensity for a domestic ETS due both to political and institutional reasons. However, trading schemes for energy efficiency and renewable energy are already in place. Kazakhstan has very definite plans for an ETS, and has in fact a draft law in parliament. Mexico has been one of the earliest proponents of a domestic ETS, but has not taken this plan much farther. South Korea has already come very far in the design of its ETS. However, due to opposition by domestic industry, targets have been weakened and the start date pushed back.

The outlook, hence, differs substantially from country to country. Kazakhstan and South Korea are the most advanced, specific emission trading bills have been put on the table in these countries. However, even here, not all design elements are clear and it is uncertain when these laws might actually be passed. China’s new commitment to absolute targets and the creation of a nation-wide scheme by 2015 gives reason for optimism. However, the implementation pathway is as yet unclear. The question is in particular how the very diverse design choices of the envisaged pilot schemes are to be aligned to form a convergent system on such short notice. Nevertheless, as Chinese announcements are becoming increasingly ambitious, the creation of a large-scale Chinese system by the middle of this decade is a distinct prospect.

Such a system by the world’s largest emitter would have a substantial impact on the market, but in general, it is not yet clear how large the emerging systems are going the be. An exception is South Korea where current plans envisage coverage of around 400 Mt CO2-eq. per year. The Korean system would, hence, have the size of ca. 1/5 of the EU ETS.

The trading systems that do emerge may not necessarily be based on GHG emissions. India is establishing trading systems for energy efficiency and renewable energy and some Chinese provinces are also considering efficiency-based systems. On the one hand, such systems might optimistically be seen as potential precursors to a GHG trading system that help to build capacity and gain first experiences with trading. On the other hand, institutional lock-in and path dependencies might prevent a later shift from energy efficiency to GHG trading.

In addition, even where GHG emissions trading is pursued, such a system will not necessarily be compatible with the global carbon market. The environmental benefits of emissions trading and by extension of linking crucially depend on the design of a trading system. This relates especially to the nature and stringency of the targets and the inclusion of cost-containment features. Through linking, such features would impact the whole combined trading scheme and, thus, impair rather than enhance its environmental effectiveness.

Finally, there is the sheer complexity of establishing an ETS. Even in the EU, where implementation of an ETS was fast-tracked as much as possible, the process from the publication of the Commission’s Green Paper on emissions trading to the start of the system took five years.

On the positive side, China, the world’s largest emitter, is becoming increasingly committed to emission trading and there is also clear interest in various other developing countries to explore the possibilities of introducing emissions trading systems. The EU is engaging with these countries through initiatives such as the International Carbon Action Partnership (ICAP) and the Partnership for Market Readiness. These initiatives should be further pursued and strengthened.

However, it can be assumed that at least until 2020, climate policy even in many of the rapidly industrialising developing countries will mainly revolve around non-ETS policies and measures. International climate cooperation should, therefore, not neglect improving the CDM and supporting transformational policies and measures through fund-based instruments.

The full paper can be accessed at: http://www.jiko-bmu.de/1054

About the Authors:

Wolfgang Sterk has been working with the Wuppertal Institute for Climate, Environment and Energy, Wuppertal, Germany, since 2002. The focus of his work is on market-based climate policy instruments (CDM, JI, EU Emissions Trading) and on the future climate regime. He has coordinated projects on, inter alia, the establishment of the CDM/JI approval process in Germany; the promotion of renewable energy technologies through the CDM; possibilities for linking the EU emissions trading scheme to schemes in Australia, Canada, Japan, New Zealand, Norway, Switzerland and the U.S.; reform of the CDM post-2012; and a comprehensive Wuppertal Institute proposal for the future international climate regime.

Florian Mersmann graduated from the University of Potsdam with a degree in Administrative Science, majoring in the study of international institutions. Since 2006, he has been working at the Wuppertal Institute, doing policy analysis in international climate politics. His work focuses on the development of political options and scenarios for international cooperation in the development and transfer of technologies, as well as financing climate change measures nationally and internationally.

Florian Mersmann graduated from the University of Potsdam with a degree in Administrative Science, majoring in the study of international institutions. Since 2006, he has been working at the Wuppertal Institute, doing policy analysis in international climate politics. His work focuses on the development of political options and scenarios for international cooperation in the development and transfer of technologies, as well as financing climate change measures nationally and internationally.