New Delhi: The United States is using the climate ‘fast start financing’ to its pervert advantage for ruining the Indian domestic solar photo-voltaic (PV) manufacturing industry – says Centre for Science and Environment (CSE) in a press release issued in August this year.

New Delhi: The United States is using the climate ‘fast start financing’ to its pervert advantage for ruining the Indian domestic solar photo-voltaic (PV) manufacturing industry – says Centre for Science and Environment (CSE) in a press release issued in August this year.

Currently, 80 per cent of the Indian manufacturing capacity is in a state of forced closure and debt restructuring with no orders coming to them, while the US manufacturers are getting orders from Indian solar power developers, say CSE’s researchers.

- US Exim Bank and the Overseas Private Investment Corporation offering low-interest loans to Indian solar project developers on the mandatory condition that they buy the equipment, solar panels and cells from US companies

- This has put 80 per cent of India’s domestic sector in crisis, even as orders are being bagged by US manufacturers

- Unethical practice, says CSE. Will do more harm than good to domestic industry

As the nation’s ambitious Solar Mission’s first phase draws to a close next year, CSE is analysing the state of renewable energy resources and infrastructure in India and the country’s preparedness to meet the Mission goals.

Explains Chandra Bhushan, CSE’s deputy director general: “Fast start financing is a US $30 billion fund set up under the United Nations Framework Convention on Climate Change. The fund, adopted at the Copenhagen climate meeting in 2009, is supposed to help developing countries deal with climate change impacts and limit greenhouse gas emissions.”

He adds: “The US has been very ingeniously using this fund to promote its own solar manufacturing. The US Exim Bank and the Overseas Private Investment Corporation (OPIC) have been offering low-interest loans to Indian solar project developers on the mandatory condition that they buy the equipment, solar panels and cells from US companies. This has distorted the market completely in favour of US companies.”

The Government of India has been aggressively promoting solar power projects since 2010 as part the National Action Plan on Climate Change. The Jawaharlal Nehru National Solar Mission (JNNSM), plans to install 22,000 MW of solar energy by 2022 by using a mix of feed-in-tariffs and Renewable Purchange Obligations (RPOs). Within three years, 2009-12, India has gone from almost zero to close to 1,000 MW of solar installations in the country.

Though the JNNSM mandates a domestic content requirement – meaning all projects must buy domestically manufactured solar equipment – it does it only for the crystalline PV technology and not for the thin-film PV technology.

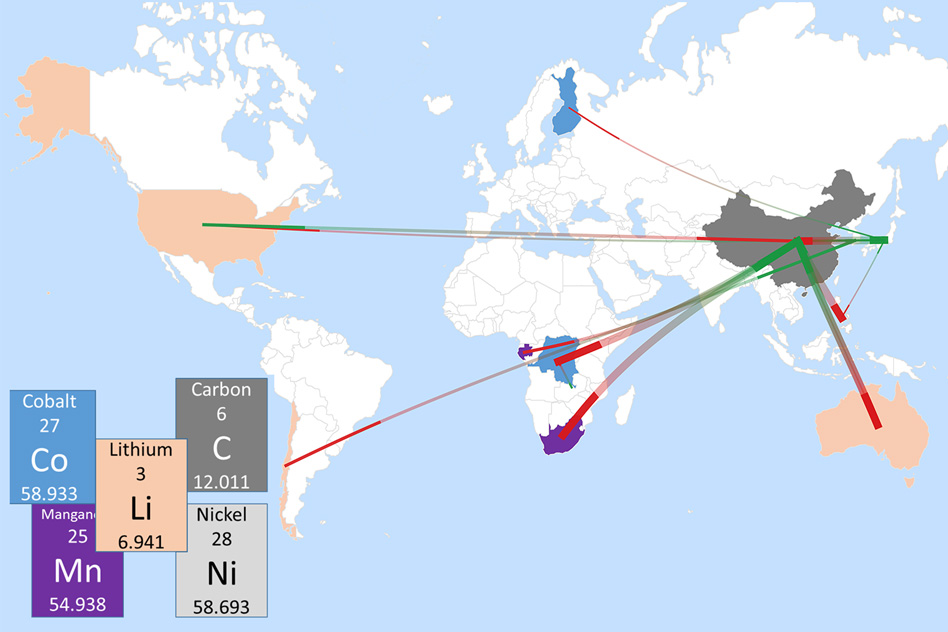

Taking advantage of this loophole – say CSE researchers – the US Exim Bank and OPIC have been offering very low rates of interest (about 3 per cent) and a long repayment schedule (up to 18 years) to Indian solar project developers on the condition that they buy thin-film panels manufactured by US companies. Loans from Indian banks come with an interest rate of close to 14 per cent or more. This has skewed the market completely in favour of thin-film panels imported from US despite the fact that thin-film has lower efficiency when compared to crystalline panels. Close to 60 per cent of the panels installed in India are thin-film type even though only 14 per cent of global capacity is thin-film.

According to the US Department of State reports of the year 2010 and 2011 on fast start financing, an amount totalling US $248.3 million has been disbursed by the US Exim Bank and the OPIC for grid-connected solar plants in India. The major beneficiaries in this case have been American producers such as First Solar and the now bankrupt Abound Solar.

As recently as on July 19, US Exim Bank authorised two other loans totalling US $57.3 million to Solar Field Energy Two Private Limited and Mahindra Surya Prakash Private Limited, respectively, “to finance the export of American solar panels and ancillary services to India”. The solar panels, again manufactured by First Solar, will be used in the construction of solar PV plants in Rajasthan. According to the US government release these “transactions will support 200 US jobs at First Solar’s manufacturing facility in Perrysburg, Ohio”.

The US is also fudging its data on fast start finance. When giving loans as aid, only the difference of the rate of interest between the ‘soft’ loan and a commercial loan is counted as aid. However, in this case, the US has counted the entire loan sum as aid under fast start finance. If a fair counting would have been done, the fast start financing amount shown by the US would be reduced to a fraction.

“The misuse of fast start financing by the US is unethical. Fast start financing was supposed to benefit the developing country recipient. Instead, the US has managed to turn it into a game where funds registered as climate funding is given out as loans to projects that promise to buy equipment made in the US thereby benefiting themselves while knocking out the Indian manufacturing competition that doesn’t have the same government backing. In the long-run, this is doing more harm than good to the Indian solar sector,” says Bhushan.

Says Kushal Yadav, head of CSE’s Renewable Energy team: “Interestingly, the US government has put anti-dumping duties on solar equipment imported from China because of the alleged subsidies that China is giving to its solar manufacturers. However, the US is engaging in a similar practice in India by subsidising loans for buying American equipment!”