ThinktoSustain.com: What would be the perceived benefits of an effective climate bonds initiative?

Sean Kidney: Our own performance indicator is the mobilization of large volumes of private finance to address climate change.

Climate Bonds hold the promise of providing investors with a quick way to pick fixed income opportunities that are independently agreed to be important to addressing climate change. Assuming these investments fit their risk/reward requirements, this will allow them to satisfy their need to address the macro risks of climate change and to report on such to key stakeholders in government and among their members.

Given constrained public sector finances, there is enormous pressure on governments to mobilize private capital for clean energy and adaptation investments. The U.S. Government has been a leader in using this tool, providing tax concessions for Clean Renewable Energy Bonds, federal guarantees for Property Assessed Clean Energy Bonds, and so on.

Many commentators expect to see a rapid increase in the use of green debt preferencing tools.

Internationally consistent tools for preferencing, like climate bond standards, would allow investors to maintain multi-country portfolios of environmentally-credible bonds. Smaller nations may find it easier to use existing standards already in use by large investors, rather than developing their own preferencing criteria.

ThinktoSustain.com: Climate bonds are based on a strong assumption that clean technology would become relatively cheaper and ultimately substitute fossil-fuel-based technology in the long-run. What evidence do you see in support of this assumption?

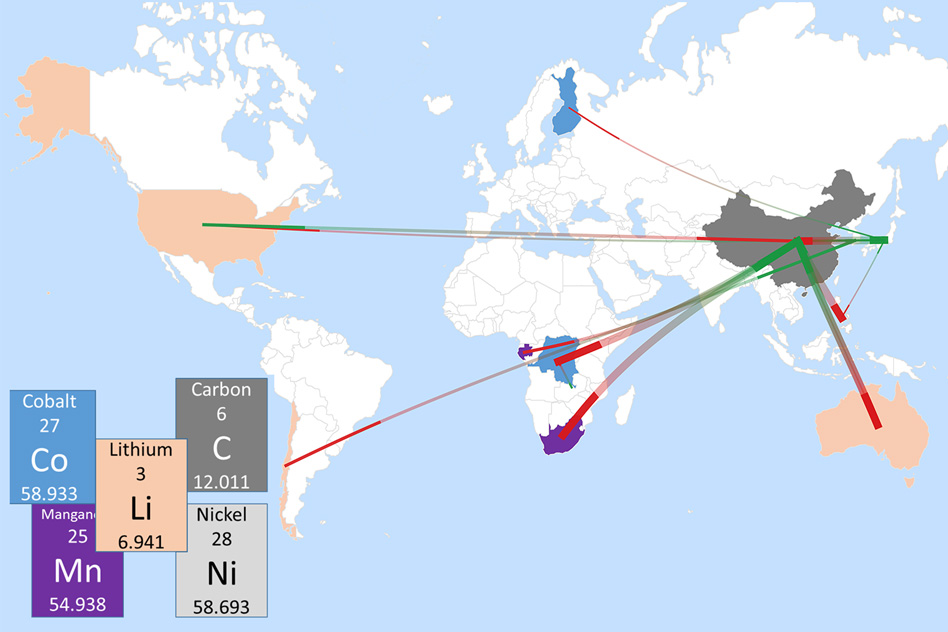

Sean Kidney: First, this is not the premise of Climate Bonds. Climate bonds can be issued against any asset that is certified to be important to addressing climate change. We expect Climate Bonds to be issued for assets in clean energy, energy efficiency, water infrastructure, agriculture, forestry and transport.

Standards will be developed for different types of projects that are judged to be important to a transition to a low carbon economy. Certification criteria for project types, that are judged to be straight-forward, such as wind and solar energy, will be developed first before moving on to project types with complex characteristics, such as such energy efficiency and bio-energy.

Some areas will require more input than others. An example would be biofuels, where debt-raising for projects such as dryland tree crops for biofuel production may possibly be seen as appropriate from an environmental perspective, whereas biofuel projects that involved destruction of forested areas would be seen to have highly negative environmental consequences and not be eligible for certification.

In terms of your other question – will clean energy substitute for fossil-fuel based energy in the long run? The answer is YES, as the unit costs of clean energy generation will drop. All clean energies are dropping in price consistently over time.

ThinktoSustain.com: Regarding adoption of climate bonds, what could be the major challenges? Which one(s) do you see as the most challenging?

Sean Kidney: Ensuring the integrity of climate claims for each prospective bond issuance will be challenging. Through the standard we are developing, we hope to make the environmental integrity and financial accountability mechanisms strong enough to enable us to evaluate the low carbon claims of the bond easily and clearly. This will be relatively easy in the early stages of the market as we plan on focusing on renewable energy bonds in particular. However, it will get a little more complicated with other types such as energy efficiency and transport, and the challenge there is to ensure there is an appropriate balance between the needs of the low carbon economy in effectiveness and the needs of the bond market in ease-of-use.

ThinktoSustain.com: Please cite some success stories (instances where climate bonds have been successfully introduced).

Sean Kidney: Climate Bonds as a separate theme are new. We are designing them as bonds compliant with a new Climate Bonds Standard – the first half billion standards-compliant climate bond will come out in May 2011.

However, there are a number of environmentally-themed bonds already in the market led by international finance institutions such as the World Bank Green Bonds Program and the European Investment Banks Climate Awareness Bonds.