Boston – In the wake of significant financial losses from the BP Oil Spill and in response to a proliferation of deepwater offshore drilling worldwide, more than 50 U.S. and other global investors have sent letters to major energy companies asking them to disclose information regarding their risk oversight measures, including spill prevention and response plans, for their own offshore oil operations around the world.

The letters, sent to CEOs at 27 oil and gas companies, were signed by 58 global investors with collective assets totaling more than $2.5 trillion, including the New York State Comptroller, California State Treasurer, Florida State Board of Administration and the UK-based Local Authority Pension Fund Authority Forum. “It is important for all companies involved in sub-sea deepwater drilling to be open and transparent with investors and stakeholders at this crucial historic moment,” wrote the investors.

“The shareholder harm that has flowed from the BP spill has focused investor attention on governance, compliance and management systems needed to minimize risks associated with deepwater offshore oil and gas development worldwide,” the letter continued. “The BP Gulf of Mexico disaster has also raised concerns about response plans by companies and the industry for dealing with offshore accidents.”

The letters were sent to 27 companies, including the world’s three largest deepwater oil producers – Petrobras, ExxonMobil and Royal Dutch Shell. It was not sent to BP or Anadarko Petroleum, which jointly owned the Deepwater Horizon rig that exploded in April, causing the world’s worst-ever spill that sent nearly five million barrels of oil into the Gulf of Mexico. Investors have seen BP’s stock fall by more than a third since the spill.

“The Gulf tragedy provided dramatic evidence that investors and pensioners have high stakes in deepwater oil exploration. In my state alone, the nation’s two largest public employee pension funds have seen the value of their BP holdings plummet by $349 million,” said California State Treasurer Bill Lockyer, who serves as a trustee on the board of CalPERS and CalSTRS, which have a combined $337 billion in assets. “Our message is simple: investors have a right to full disclosure of the risks associated with oil companies’ offshore operations, and the prevention, response and governance measures they have in place to minimize those risks.”

“Investors are rightly raising questions about whether and how the rest of the oil industry is prepared to manage the risks associated with the industry’s move toward increasingly extreme water depths and operating conditions to find oil,” said Andrew Logan, Oil Program Director at Ceres, a leading network of investors and environmental groups which helped organize the investor letters. “The BP disaster demonstrates that the shift to deeper waters comes with a significantly increased risk profile, and that the cost of getting environmental risk management wrong has increased dramatically.”

The letter includes questions on five key topics: company investments in spill prevention and response activity, including offshore drilling and spill response capability; spill contingency plans for managing deepwater blowouts; lessons learned from the BP spill, including their position on possible new regulations and more robust enforcement on offshore drilling in the Gulf and elsewhere; possible actions to improve their safety contractor selection and oversight practices; and governance systems for overseeing management of offshore oil and gas operations. Companies are asked to respond by November 1.

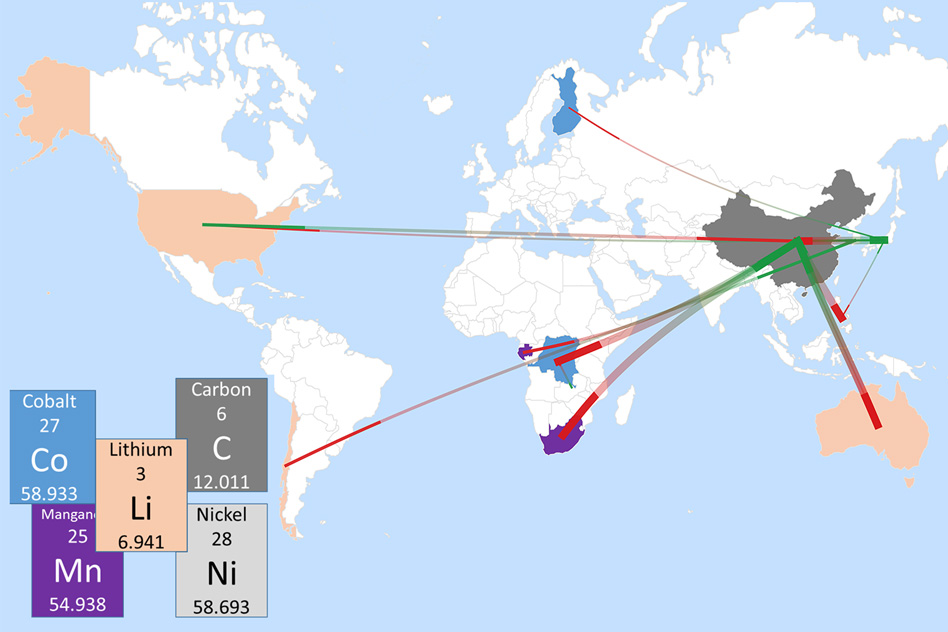

Deepwater offshore drilling has become increasingly critical to the global oil industry, accounting for roughly half of new oil discoveries over the last five years. Companies like BP, ExxonMobil and Royal Dutch Shell are especially eager to explore in deep waters because most of the world’s oil land-based reserves are in the hands of state-controlled companies.

Deepwater oil production capacity (2,000 feet or deeper) has tripled since 2000 to five million barrels a day and has the potential to double again by 2015, according to Cambridge Energy Research Associates. There are now 14,000 deepwater wells worldwide.

“Investors are by definition risk takers, but our risks need to be calculated and measured,” said New York State Comptroller Thomas P. DiNapoli, sole fiduciary of the NYS Common Retirement Fund. “Investors have a right to know that our companies are taking all necessary steps to maximize opportunities without sacrificing safety. We believe improved practices and policies to mitigate risk will ultimately improve the bottom line, which is good for all investors.”

“The Deepwater Horizon disaster was a game-changer for shareholders,” added Pennsylvania State Treasurer Rob McCord. “It demonstrated the catastrophic consequences that can result when firms fail to provide essential risk assessment. Information is power – and it helps investors manage risk.”

“Would I invest in an offshore drilling company if its disclosure statement revealed that its ‘rapid response’ to a catastrophic oil spill involved the unproven technique of stuffing golf balls, hair clippings and shredded tires down a well? Probably not,” McCord added.

A second letter was sent by most of the same investors to 26 insurance companies that provide insurance for offshore drilling activity. The letter asks if insurers are, among other questions: considering adjustments to their overall exposure to offshore oil and gas operations, including possible changes in policy volume; considering changes in their underwriting criteria; supportive of new regulations that would reduce offshore drilling risks.

Swiss Re has estimated that total insured losses for all affected parties from the BP rig explosion and spill could top $3.5 billion – a figure that would surpass the $2.2-$2.5 billion in annual insurance premiums worldwide for oil and gas exploration.

The oil and insurance letters and the investor signatories to each of those letters is available at www.ceres.org/oilletters