Washington, D.C. – International Finance Corporation (IFC), a member of the World Bank Group, on April 27 launched its first Green Bond in the U.S. market, raising $ 500 million for climate-friendly investments in emerging markets. This is the first IFC green bond targeting U.S. investors.

Washington, D.C. – International Finance Corporation (IFC), a member of the World Bank Group, on April 27 launched its first Green Bond in the U.S. market, raising $ 500 million for climate-friendly investments in emerging markets. This is the first IFC green bond targeting U.S. investors.

“IFC is a leader in promoting climate-friendly investment in developing countries,” said IFC Executive Vice President and CEO Lars Thunell. “This bond will strengthen our ability to invest in innovative energy-efficiency and renewable-energy projects that can help these countries confront climate change.”

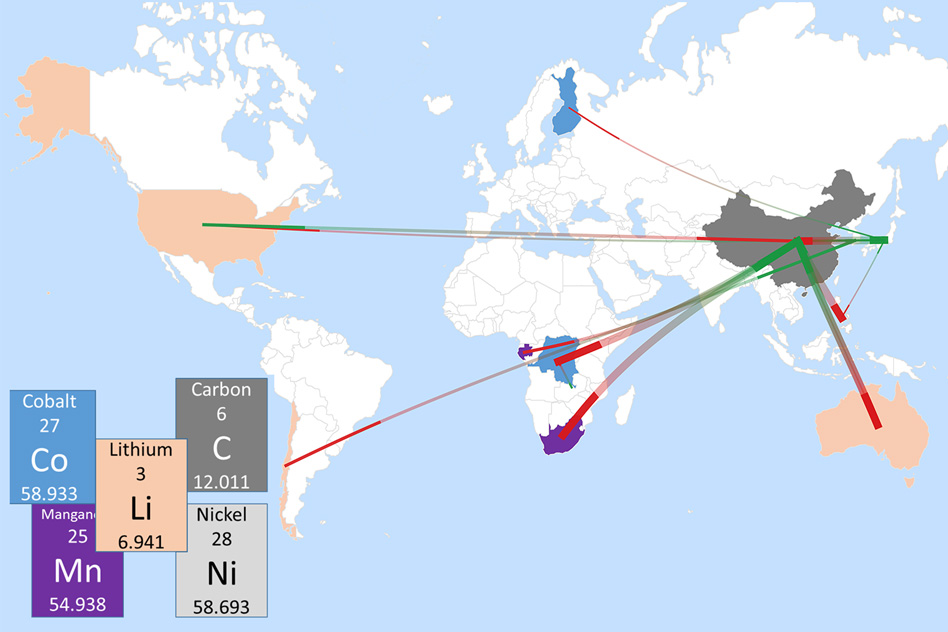

Funds raised from IFC green bonds are set aside in a separate account for investing exclusively in renewable energy, energy efficiency, and other climate-friendly projects in developing countries. Through IFC green bonds, investors can directly support climate change-related projects in the developing world.

“The U.S.-dollar market is an integral part of our strategy to support the development of the private sector,” said Jingdong Hua, IFC Vice President and Treasurer. “Green bond issues in the U.S. market have been rare, compared to Europe and Asia. IFC green bonds are an alternative investment opportunity for this market, offering both development impact and a safe investment vehicle of a top triple-A issuer.”

The issue was well-received and supports IFC’s strategy of broadening its appeal to the U.S. domestic investor base. Some investors include BlackRock, TIAA-CREF, California State Teachers’ Retirement System (CalSTRS) and United Nations Joint Staff Pension Fund.

IFC promotes climate-friendly investments using its own and donor funds. In fiscal 2011, IFC’s climate-related investments totaled $ 1.7 billion.

J.P. Morgan was the lead arranger for the issue.

IFC Green Bond Summary Terms and Conditions

Issuer: International Finance Corporation

Issue Ratings: Aaa / AAA

Format: Global

Size: U.S. $ 500 million

Maturity: May 15, 2015

Coupon: 0.50% S/A

Price: 99.865%, CT3+16.7

About IFC

IFC, a member of the World Bank Group, is the largest global development institution focused exclusively on the private sector. It helps developing countries achieve sustainable growth by financing investment, providing advisory services to businesses and governments, and mobilizing capital in the international financial markets. In fiscal 2011, amid economic uncertainty across the globe, they helped clients create jobs, strengthen environmental performance, and contribute to their local communities – all the while driving their investments to an all-time high of nearly $ 19 billion. For more information, visit www.ifc.org.

Source: IFC.