Durban – On November 30, the German environment organization urgewald, the South African social and environmental justice organizations groundWork and Earthlife Africa Johannesburg, and the international network BankTrack presented new research on the portfolios of the world’s leading banks. The study “Bankrolling Climate Change” examines commercial banks’ lending for the coal industry and provides the first comprehensive climate ranking for financial institutions.

“We chose to look into coal financing as coal-fired power plants are the biggest source of man-made CO2 emissions and the major culprit in the drama of climate change,” explains Heffa Schuecking of urgewald. “In spite of the fact that climate change is already having severe impacts on the most vulnerable societies, there is an abundance of plans to build new coal-fired power plants. If banks provide money for these projects, they will wreck all attempts to limit global warming to 2°Celsius,” says Schuecking.

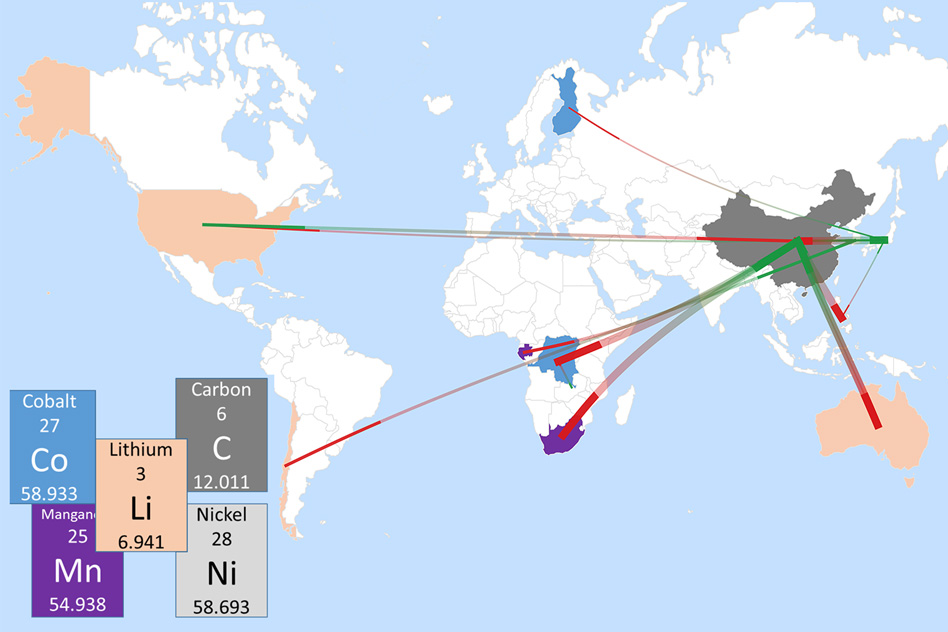

The organizations examined the portfolios of 93 of the world’s leading banks and looked into their support for 31 major coal-mining companies (representing 44% of global coal production) and 40 producers of coal-fired electricity (which together own over 50% of global coal-fired generation capacity). The total value of coal financing provided by these banks since 2005 (the year the Kyoto Protocol came into force) amounts to 232 billion Euro.

The study identifies the top twenty “”climate killers”” in the banking world. Among the top twenty are banks from the United States, the United Kingdom, Germany, France, Switzerland, China, Italy and Japan. The top three banks fuelling climate change worldwide are JP Morgan Chase (EUR 16,5 bio.), Citi (EUR 13,7 bio.) and Bank of America (EUR 12,6 bio.).

Coal-fired power plants are not cheap to build. Typically, a 600 Megawatt plant will cost around US $ 2 billion. Power producers, therefore, rely heavily on banks to provide and mobilize the necessary capital for coal plants. “Our figures clearly show that coal financing is on the rise,” notes Tristen Taylor of Earthlife Africa Johannesburg. “Between 2005 and 2010, coal financing almost doubled. If we don’t take banks to task now, coal financing will continue to grow,” he warns.

The study looks into the statements of the top climate killer banks and also examines their existing climate policies. “Interestingly, almost all of the top twenty climate killer banks in our ranking have made far-reaching statements regarding their commitment to combating climate change,” explains Yann Louvel of BankTrack. “However, the numbers show that their money is not where their mouth is.” He also notes that the policies many banks have adopted and the voluntary initiatives they have signed on to like the “Carbon Principles” or the “Climate Principles” have failed to make any difference in banks’ portfolios.

“Our study names and shames the banks that are destabilizing our climate system,” says Bobby Peek from groundWork. “Plans for new coal fired power plants and coal mines are meeting with fierce resistance all over the world and we are going to begin turning that heat on the banks,” explains Peek.

The study calls on banks to become responsible climate actors and to quit coal. According to these NGOs, banks need to shift their portfolios to renewables and energy efficiency, and set and implement ambitious CO2 reduction goals for their financed emissions.

The table shows the top twenty financiers of the coal industry since 2005.

Top Twenty Climate Killer Banks

The study was presented at a side event during COP17 in Durban on November 30th in the Hex River room. The underlying data for this research were provided by Profundo economic research.

Source: BankTrack.org.

[Photo Credit: Rainforest Action Network]