- Gas wins globally in race to meet energy demand, but won’t be a ‘game changer’

- Blackout risks rise in Europe and North America but ease in developing markets

- Fuel poverty concerns increase for power industry

- Industry predicted fossil fuel energy mix by 2030 falls well short of climate change goals

Even with new generation capacity plans, power industry executives expect blackout risks to rise in Europe and North America, as the industry confronts the challenge of energy affordability, efficiency, and energy security policies not meeting demands. There are also worries that the number of consumers in fuel poverty will rise significantly in the next 20 years.

The findings, from PwC’s 12th Global Power & Utilities Report – ‘The Shape of Power to Come’ – surveyed the views of 72 power and utilities companies in 43 countries. Analyzing the big issues facing the industry now, and what the world of electricity would look like in 2030, the report underlines the immense changes and challenges lying ahead for the power industry.

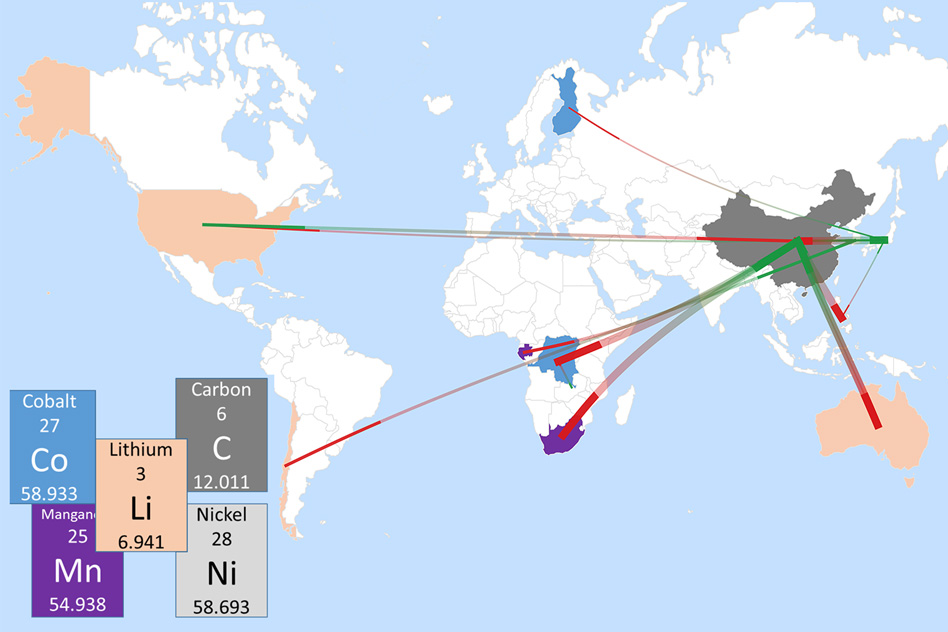

With energy demand predicted to rise from 17,200 TWh in 2009 to over 31,700 TWh in 2035*, gas heads the list of investment priorities for new generation at double the rates of support for coal or nuclear generation. Despite this, it will not be a game changer, says the power industry, with its share of the fuel mix predicted to rise from 29% now to 33% in 2030.

In overall terms, power industry expects its fuel mix to change from 66% fossil fuels vs. 34% non fossil fuel today to 57% vs. 43% in 2030. While this moves the industry closer to recognized industry predictions to meet demand, it falls well short of what is needed by 2030 to limit global warming to an average of 2°C.

Manfred Wiegand, global power and utilities leader, PwC, said: “The industry and governments face a trilemma in the balance between affordability, security and sustainability. The outcome for key issues such as climate change and energy availability remains on top of the agenda. Investment has become more difficult and a majority report concerns about a shortage of capital for infrastructure projects. Reduced demand during the economic downturn has bought some breathing space in the race to meet global warming and power infrastructure challenges. But our survey highlights a considerable degree of concern that outcomes may not be good by 2030 if investment availability and policy issues are not resolved.”

With worries about affordability and the pace of infrastructure investment in western power markets translating into unease about security of energy supply, Europe and North America are now more concerned about the blackout risks than those in developing markets. In Europe and North America, close to half (46%) predict an increased blackout risks up until 2030, while in developing markets, where power cuts are currently more commonplace, 53% expect them to reduce.

Fuel poverty has moved up the agenda, with the majority admitting it’s a fundamental industry concern, with expectations that the number of customers in fuel poverty will increase significantly over the next 20 years, particularly in Europe and South America. Two thirds of respondents see the ability to recover costs fully from customers as a barrier to meeting demand growth.

Smart Metering / Grids

Views on smart grids and metering highlight the gap to be bridged between domestic consumers and the power industry. This is particularly noticeable in North America and Europe, where 80% and 74% of respondents respectively, are worried about customer engagement being an obstacle to realizing the full potential of these technologies.

Steven Jennings, UK power and utilities leader, PwC, said: “Smart grids and smart metering are high on the list of investment priorities and yet a mix of customer apathy and concerns about data usage are already seen as constraints which could limit the potential for these new technologies. It will come down to building trust and transparency with customers to encourage and incentivise behaviour change.”

“One in four power industry executives are waking up to the fact that the new competitive threat could be big customer brands outside the power sector that consumers know and trust.”

Renewables / Clean Energy

The scale of new generation capacity needed to cope with increasing demand will boost the renewables industry‘s case, with many – over 80% – believing onshore wind, biomass and all forms of solar will not need subsidies to compete by 2030. Overall, participants expect a major ramping up of non-hydro renewables to meet 2030 power demand scenarios.

Also, three fifths of respondents think electric cars will form a significant proportion of the world vehicle fleet by 2030. New technologies and systems able to cope with a more mobile consumers will be key – three out of five survey participants stated the infrastructure needed for electric-powered transport will be a major challenge for utilities.

Source: PricewaterhouseCoopers (PwC).

Notes:

* IEA World Energy Outlook 2011