Zurich / New York – SAM, the investment boutique focused exclusively on Sustainability Investing, and Dow Jones Indexes, a leading global index provider, on September 8 announced the 2011 results of the Dow Jones Sustainability Indexes (DJSI) Annual Review.

Following SAM’s comprehensive Corporate Sustainability Assessment, 41 companies will be added to, and 23 firms will be deleted from the Dow Jones Sustainability World Index (DJSI World), resulting in a total of 342 components. The largest additions (by free-float market capitalization) to the DJSI World include Medtronic Inc., Schneider Electric S.A. and Societe Generale S.A., while the largest deletions (by free-float market capitalization) are Coca-Cola Co., Hewlett-Packard Co. and EnCana Corp. All changes will become effective with the open of the stock markets on September 19, 2011.

The 2011 DJSI review also yielded the following regional index component changes:

Michael Baldinger, CEO, SAM, said, “In spite of the current economic turmoil, it’s clear that sustainability remains a high priority on corporate and investor agendas. Through the DJSI, we are pleased to provide access to a benchmark that offers investors exposure to sustainability leaders in each sector around the world, while also enabling them to create innovative passive and structured products.”

Michael A. Petronella, President, Dow Jones Indexes, expressed, “The DJSI have become the gold standard in recognizing the world’s corporate sustainability leaders. These indexes have become an invaluable market tool for those seeking to support companies that are committed to creating and adopting sustainable business practices.”

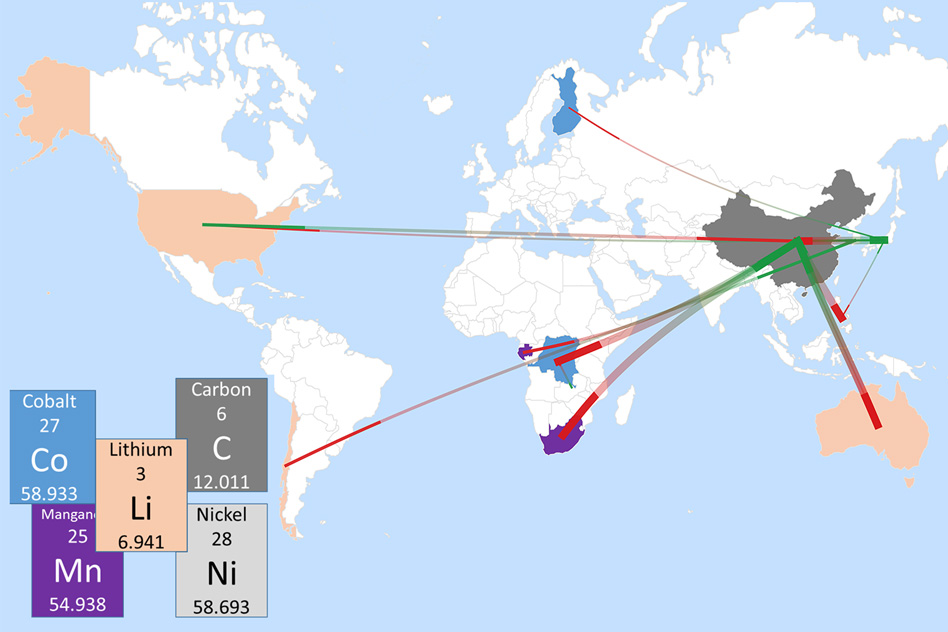

The DJSI follow a best-in-class approach, including companies across all industries that outperform their peers in numerous sustainability metrics. Each year, SAM invites the world’s 2,500 largest companies, measured by free-float market capitalization, from the 57 sectors to report on their sustainability performance. The result of the Corporate Sustainability Assessment provides an in-depth analysis of economic, environmental and social criteria, such as corporate governance, water-related risks and stakeholder relations, with a special focus on industry-specific risks and opportunities.

SAM annually identifies the top company in each of the 19 super-sectors into which the 57 sectors roll up. The 2011-2012 super-sector leaders are:

Launched in 1999, the DJSI are the first global indexes tracking the financial performance of the leading sustainability-driven companies worldwide. Today, the index family has approximately USD 8 billion in assets under management in a variety of financial products including mutual funds, separate accounts, notes and exchange-traded funds (ETFs). With approximately 60 licenses, the DJSI have been linked to financial products in 16 countries, an indication of investors’ increasing appetite to utilize the index as a means to reflect their sustainability convictions within their portfolios.

About SAM

SAM is an investment boutique focused exclusively on Sustainability Investing. The firm’s offering comprises asset management, indexes and private equity. Its asset management capabilities include a range of single-theme, multi-theme and core sustainability investment strategies catering to institutional asset owners and financial intermediaries in Europe, the United States and Asia-Pacific. Based on its Corporate Sustainability Assessment, SAM has compiled one of the world’s largest sustainability databases and analyzes over 2,000 listed companies annually. SAM is a member of the global asset manager Robeco, which was established in 1929 and offers a broad range of investment products and services. SAM was founded in 1995, is headquartered in Zurich, and employs over 100 professionals. As of June 30, 2011 SAM’s total assets amounted to USD 16.4 billion.

About Dow Jones Indexes

Dow Jones Indexes is a leading full-service index provider that develops, maintains and licenses indexes for use as benchmarks and as the basis of investment products. Best-known for the Dow Jones Industrial Average, Dow Jones Indexes offers more than 130,000 equity indexes as well as fixed-income and alternative indexes, including measures of hedge funds, commodities and real estate. Dow Jones Indexes is a joint venture company which is owned 90 percent by CME Group Inc. and 10 percent by Dow Jones & Company, Inc., a News Corporation company.

Source: Dow Jones Indexes.