3. Create Access to Relevant Networks

First relationship, then business – understanding and implementing this formula is of high importance for companies doing business in India. It is part of the age-old norms and value-systems. As Reliance founder Dhirubhai Ambani put it: “Between my past, the present and the future, there is one common factor: relationship and trust.”

Generally speaking, most Indians place a very high value on personal trust. In India, there also has been a tradition of family business, which has nurtured a culture of trust and relationships in businesses. Also, the legal system in India makes trust and communities of interest important. Cultivating the necessary relationships, of course, takes time and patience (See Point 8).

This means that company representatives have to be physically present in the country in order to develop their relevant networks and partnerships to potential suppliers, partners and clients. Especially in young and dynamic markets such as the renewable energy sector, creating effective links with policy-makers, bureaucrats, opinion leaders and other relevant decision makers at centre, state and local levels is necessary to be part of new developments and trends as well as to gain access to relevant information for business development (See Point 2).

The goal should be to create local stakeholders who share an interest in the company’s success. “How to create an army of dependent local entrepreneurs?” is perhaps the definitive poser for MNCs and new entrants.

4. Adapt Technology to India’s Needs and Market Trends

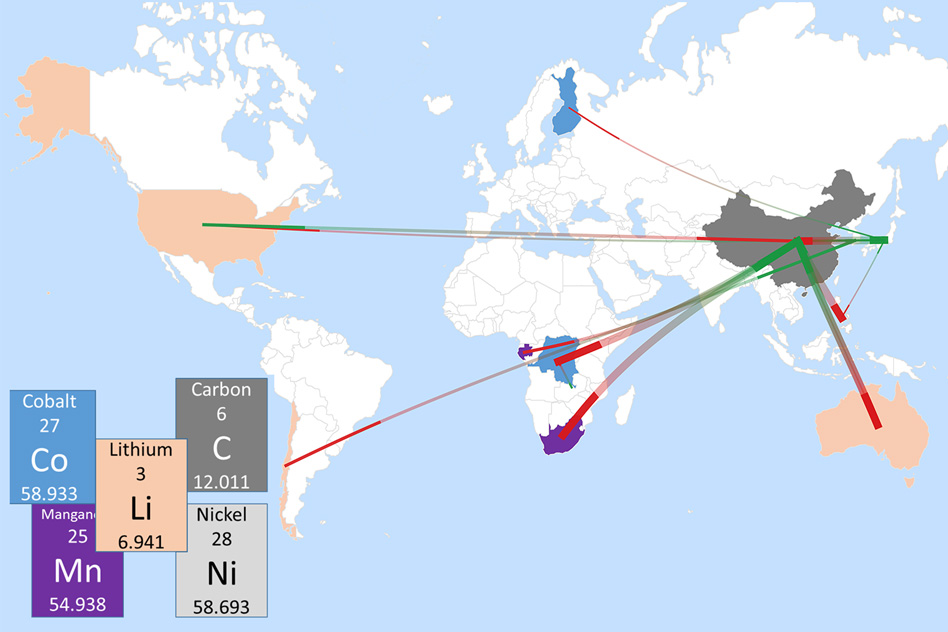

Due to low-cost solutions from neighboring markets such as China, price competitiveness in the Indian renewable energy market is extremely high. Additionally, investment decisions are – much more than in Western markets – driven by fast return-on-invest-expectations and hesitant local financing frameworks.

The current bankability bottle-neck in the solar market is a good example.[2] Indian commercial banks are unsure about the generation capacities of power plants and are hesitant to extend debt to the projects. The banks are also concerned about the reliability of Power Purchase Agreements (PPAs) and the heavily discounted tariffs that have resulted from the bidding process. International technology companies have to find their unique niche – or they have to reduce costs to be competitive through a redesign of their products or production processes. This will often require localization: setting up a local manufacturing unit to become price competitive and understanding the market.

Sometimes, some form of partnership with an Indian company, adaptation of products and business practices to Indian requirements, and in the long run, the development of India-specific technology are required. It is difficult to assess the risks clearly – there will always be an element of risk that can be mitigated if the corporate are responsive and believe that the India story is true.

The research project, “Creating an Evaluation Model for the Transfer of Environmental Technology to India”, conducted by BRIDGE TO INDIA and the Technical University of Munich, affirms these findings. In the project, we are working on identifying specific market barriers and success factors for international renewable energy technologies in India together with 16 German renewable energy companies. One result will be an IT-tool to generate and evaluate specific risks and opportunities as well as cash-flow calculations from scenarios based on individual market entry strategies. BRIDGE TO INDIA and the Technical University of Munich will soon publish first results.

5. Integrate the Informal Sector into Your Core Business Model

India’s education system creates 3.7 million university graduates every year. A large number of young Indians also take the opportunity to study abroad. In 2009 alone, more than 250,000 Indian students went abroad for studies; mostly in USA (over 100,0000), UK (more than 60,000[3]), and Australia (around 30,000[4]).

On the other hand, there is an immense amount of unemployed youth in India (27 million as in 2008[5]). This number will increase tremendously in the next years due to population growth and a lack of job opportunities for unskilled labour. Hundreds of millions of Indians – currently 95% of the total work force – will continue to be in informal, non-contractual work relationships. These “simple” jobs keep the Indian system running and are extremely important for the functioning of most corporate processes.

International companies have to learn how to incorporate the informal sector into their core business processes in order to sustain the quality and delivery of their offerings in India. Also, it is important to remember that the informal work force forms a large part of a new and immense consumer base in India. Bottom-of-the-Pyramid (BOP) business models help corporate to involve local stakeholders and maintain their ‘licence to operate’. Especially in the area of renewable off-grid solutions lies a huge potential. Providing electricity to urban and rural poor by involving the local workforce and targeting low-income consumers helps to innovate new and cheaper products to tap large new markets.

One example is Veolia Water’s activity. The French company in cooperation with Grameen in Bangladesh developed a new and socially sustainable business model to provide the poor with drinking water. Grameen Veolia now pipes its arsenic-free water to 19 tap points in villages surrounding the plant, and they are working to expand this network further. Along with the sales of the water, Grameen Veolia has been introducing awareness campaigns on drinking water in partnership with local governments, schools and religious leaders.

6. Focus on Developing One Successful Pilot Project – However Small

International technology companies have to gain experience in the Indian market to be successful in the long-term – and showcase that their technology also works under local circumstances. Especially in the field of renewable energy, creating a track record is of significant importance in order to convince banks and investors of their product in India. Based on the generated knowledge, the company can test its adapted business model, correct mistakes, if required, and improve upon it.

For example, Azure Power of India did a solar PV pilot project in Punjab (2 MW), which was also India’s first privately-operated, utility-scale, solar power plant. With the success of this project, Azure Power started new projects. The company has now set itself an ambitious target of having an installed capacity of 100 MW by 2013 and has been actively working with various stakeholders in this regard. Azure Power is currently building 22 megawatts of power projects in the states of Punjab, Rajasthan and Gujarat.