Shanghai – A new survey released April 18 by Deloitte Touche Tohmatsu Limited’s (DTTL) Global Manufacturing Industry group shows that 93 percent of Chinese consumers are interested in buying or leasing an electric vehicle (EV). The survey, conducted among 1,163 consumers in China, coincides with the 14th Shanghai International Automobile Industry Exhibition (Auto Shanghai 2011) this week, where low-carbon, green economy, and sustainable development will be key themes.

“As China is the largest automotive market in the world, this is great news for players in the EV market,” says Craig Giffi, DTTL Global Automotive Sector Leader, who is presenting at the Shanghai Automotive Summit April 18. “Of the world’s four dominant automotive markets – China, United States, Europe and Japan – Chinese consumers stand out as ‘potential first movers’ in the adoption of EVs. Fifty percent of Chinese consumers surveyed identify themselves as ‘potential first movers’ in purchasing or leasing an electric vehicle compared with 12 percent in the United States, 16 percent in Europe, and 4 percent in Japan.”

“China’s 12th five-year plan will likely help to spur the development and adoption of electric vehicles,” remarks John Hung, Managing Partner, Automotive Sector, Deloitte China. “The plan anticipates growth of urbanization, an increase in research and development to 2.2 percent of GDP, and the reduction of carbon emissions by 17 percent. These factors are likely to create conditions that are ripe for EVs.”

The survey also shows a tipping point in terms of fuel prices that is influencing consumer adoption of EVs. Sixty-six percent of Chinese consumers surveyed say they are “much more likely” to consider an EV if the cost of fuel rises to 10 RMB a liter (US $ 1.53). At 12 RMB a liter (US $ 1.83), the majority of respondents (85 percent) would be even more motivated to purchase an EV. However, if fuel efficiency reaches more than 3.0 liters per 100 kilometers in ICEs, 82 percent would be less willing to purchase an EV.

“The challenge for automakers in China with respect to mass adoption will be to maximize their margins while pricing EVs to meet the expectations of consumers,” says Po Hou, Managing Partner, Automotive Sector, Deloitte China. “As many consumers are not likely to pay a premium for EVs, government incentives such as personal subsidies will be very important to their purchasing decisions.”

More than half (61 percent) of the Chinese consumers surveyed are not willing to pay a price premium for an EV of more than 6,700 RMB (US $ 1,023), compared to a regular car (internal combustion engine vehicle). Only 14 percent are willing to pay a price premium of more than 20,000 RMB (US $ 3,055). Moreover, the majority of these consumers (52 percent) expect to pay less than 130,000 RMB (US $ 19,856) net of government incentives.

“Global mass adoption of electric vehicles will be significantly influenced by a number of factors, including rising fuel prices, advancements in internal combustion engine vehicles (ICEs), and the availability of government incentives,” says Giffi. “While interest in battery electric vehicles (BEV) is growing, current market offerings generally fall far short of consumers’ expectations for driving range, charging time, and purchase price.”

According to the survey, the combined consumer expectations in China, the United States, Europe, and Japan for EV range are two to three times (320 to 480 kilometers or 200 to 300 miles) the current market offering (160 kilometers or 100 miles) from major automotive manufacturers. Additionally, the expectations for the majority of consumers in these markets is a charge time of two hours or less (55 percent in China, 60 percent in the United States, 67 percent in Europe, and 81 percent in Japan) compared to the expected eight-hour charge time (required using Level II chargers with a 24 kWh battery pack) typical for current market offerings.

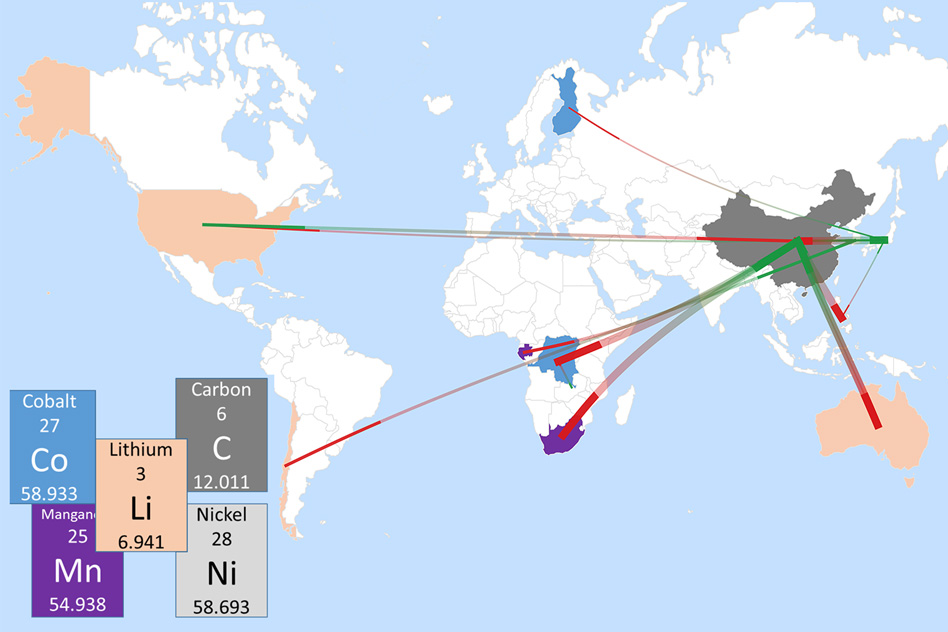

Currently, hybrids and BEVs represent a fraction of total cars on the road globally. The adoption of all forms of green vehicles – hybrids, BEVs, etc. – will be significantly influenced by government policies that will heavily shape the portfolio mix of powertrain technologies in each country as discussed in an earlier released DTTL report, “A New Era. Accelerating Toward 2020 – An Automotive Industry Transformed”. These policies will be driven by a number of factors from stricter carbon emission standards to independence from foreign energy.

Additional findings from the survey include:

- Compared to consumers in other markets such as Europe, Japan and the United States, consumers in China appear to be more familiar with EVs. Almost all of the respondents were at least somewhat knowledgeable about EVs, with 42 percent being “extremely” or “very knowledgeable”. Among ‘potential first movers’, 63 percent said they were “extremely” or “very knowledgeable” about EVs.

- For more than 80 percent of respondents, convenience to charge, range, and cost to charge were all “extremely important” or “very important” considerations for buying or leasing an EV.

- The vast majority of respondents have requirements that are not currently met by pure EVs in the market today:

- Range of up to 320 kilometers (69 percent of respondents)

- Charging time of two hours or less (55 percent of respondents)

- Widespread availability of public charging stations (72 to 85 percent of respondents)

- ‘Potential first movers’ in China described themselves as being environmentally-conscious, tech-savvy, trend-setters, and politically-active. These early adopters are generally between the ages of 18 to 35 years old (50 percent) or 35 to 54 years old (49 percent), have a bachelor’s degree or higher (86 percent), are male (48 percent), live in urban areas, and are affluent (36 percent have incomes greater than 400,000 RMB or US $ 61,072).

- Most survey respondents perceive EVs as better than ICEs in their impact on the environment (82 percent), availability of government incentives (76 percent), cost to operate (69 percent), cost of repair and maintenance (56 percent), and safety (53 percent). However, ICEs were seen as better in their range before refueling or recharging.

- The most common perception was that EVs were “green and clean” (89 percent), while nearly two-thirds of respondents also perceived EVs as safe (68 percent), stylish (67 percent), and inexpensive to operate (65 percent).

- Respondents said they would be most likely to use an EV for commuting to work (average 37 percent of expected driving time) or for short local trips (average 25 percent of expected driving time).

- More than half (55 percent) of respondents said if they were to purchase an EV, the longest that they would be willing to wait to fully recharge the battery was two hours or less. And only 18 percent find eight hours of charge time acceptable.

- The Full Useful Life of the battery, as well as ease and cost of switching batteries, are important factors to Chinese consumers as they begin to contemplate the total cost of ownership.

Check the following link to read/download Deloitte’s Survey:

www.deloitte.com/electricvehicle