Amsterdam – Confidence is growing in the EU’s Emissions Trading Scheme (EU ETS), according to respondents to the sixth annual carbon market survey carried out by Thomson Reuters Point Carbon, the leading provider of market intelligence, news, analysis, forecasting and advisory services for the energy and environmental markets.

Some 49% consider the EU ETS the most cost-effective instrument for reducing emissions in the EU. This is the highest level since the survey began and up from 43% last year. Furthermore, responses from the European power and heavy industry sectors showed that a record 59% said that that the EU ETS had already caused them to reduce their own emissions with a further 9% saying that the EU ETS has prompted reductions to be planned.

Participants in the EU ETS also appear to be better informed about their situation in the next phase of the programme, starting in 2013. Fewer respondents (25%) were “very uncertain” as to their level of free allocation in Phase 3, compared to 37% last year. The share of respondents who believe that the EU ETS is a mature market is also up, reaching 37% this year after continuous growth from 10-11% in 2006-07.

“After the recent cyber attacks and thefts of EU Allowances (EUAs), there was talk of the EU ETS having been discredited; however, our survey shows quite the reverse, that confidence in the scheme among participants is growing and that the EU ETS gains in maturity and results in more emissions cuts each year,” said Endre Tvinnereim, Senior Analyst at Thomson Reuters Point Carbon and one of the authors of the report.

However, the Clean Development Mechanism (CDM) still represents an immature market, according to respondents. Only 18% agree that “the CDM market is mature” and only 31% consider the CDM market the most cost-efficient way to reduce emissions in developing countries, against 34% who disagree.

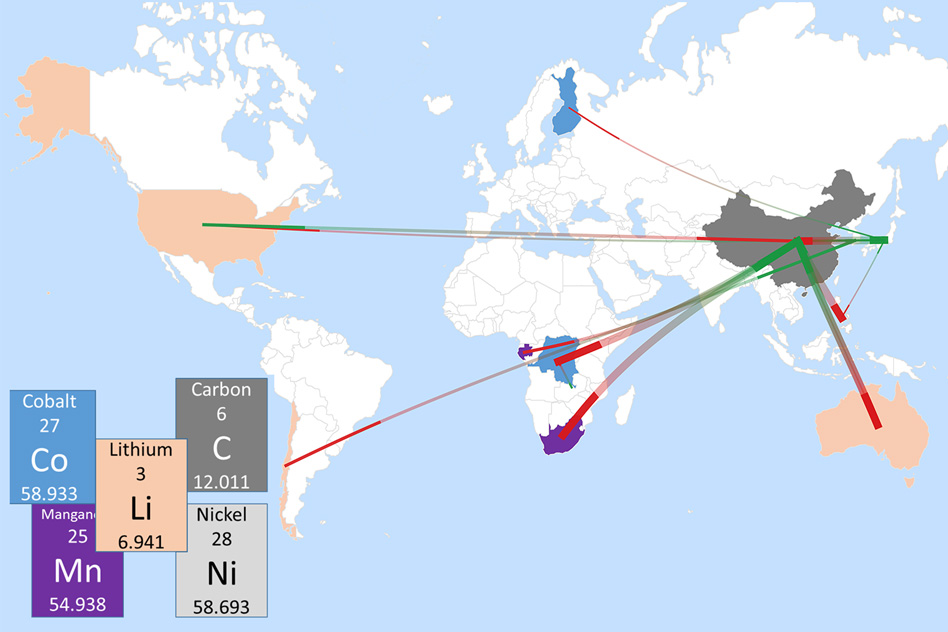

Tvinnereim explains: “In the offsets sphere, market players are looking at new project types and host countries beyond those that dominate the CDM today. Within the CDM, we see that many investors and developers are looking at investments in least developed countries (LDCs), motivated by the EU’s exclusion of non-LDC projects registered after 2012. “

More than half of respondents involved in the primary CDM market say they have invested, or will invest, in LDCs. Over the next three years, the same respondents find it most likely that 50-100 CDM projects in LDCs will be registered. “While this figure is small compared to the 2,800-odd CDM projects that have already been registered, it demonstrates that investors are ready to adapt to a changing demand situation in the global carbon markets,” explained Tvinnereim. Changes are also anticipated elsewhere, with a majority of respondents expecting further qualitative restrictions in the EU ETS. A total of 56% think the EU will ban project types beyond HFC and adipic acid N2O.

Beyond the CDM, there are a number of proposals for how to use market mechanisms to reduce greenhouse gas (GHG) emissions in developing countries. Among emerging offsets, respondents find reduced deforestation (REDD) credits most likely to emerge by 2016. Sectoral crediting and credits from nationally appropriate mitigation actions (NAMAs) are seen as the least likely, with bilateral, sector and EU domestic offsets in the middle.

Looking at the carbon picture in 2010 as a whole, Elizabeth Zelljadt, Senior Analyst, Thomson Reuters Point Carbon, explains that it was particularly significant for two reasons. “There was a failure to move forward with climate legislation in various industrialized countries, most notably the US. However, there were also renewed signs of life within the international process in the shape of the Cancun Agreements in December which restored faith in the multilateral climate change negotiation process.” Whilst the survey shows slight overall dissatisfaction with the Cancun outcome, the Cancun COP is viewed much less negatively than the Copenhagen COP one year earlier when some 70% of respondents expressed dissatisfaction with the outcome.

Zelljadt continues: “With the focus in North America shifted from US federal climate policy to regional initiatives, all eyes have turned to California, which will be launching its own emissions trading programme in 2012, not dissimilar to RGGI on the West Coast, but larger in terms of emissions covered, with close to 400 Mt covered in 2015.” Most respondents to the survey expect an initial carbon price of $10-15/t, rising to between $17/t and $50/t in 2020.

“California is already preparing for its emissions trading scheme now, and although it has not yet launched, emissions reductions are already taking place or being planned in just over half the respondents’ companies,” she said.

Veronique Bugnion, Global Head of Trading Analytics at Thomson Reuters Point Carbon, concludes that, “after Copenhagen and again after Cancun, the contours of a bottom-up global climate system are getting clearer. It is looking less likely that the Kyoto Protocol will have a second commitment period, notably after Japan’s refusal to continue Annex B commitments. Rather, the individual country targets submitted under the Copenhagen Accord are pointing toward a pledge-and-review system where governments decide for themselves what targets they will set and how they will meet them”.

Despite the pledge-and-review framework that we see emerging, a majority of survey participants expect continued Kyoto commitments for rich countries. Not unexpectedly, CDM and JI project developers are the most bullish on Kyoto, while Japanese and New Zealand compliance entities show the least faith in future quantitative targets under the Protocol. This disjuncture is probably based in part on hopes, part on expectations. Nevertheless, carbon market participants are right to ask for a clarification, possibly in Durban in December, although nobody should be surprised if Kyoto’s future gets kicked into the sand once more. Even so, all the signs are that global carbon markets will continue to grow both in volume and value this year and next”.

Notes:

- Carbon 2011, Point Carbon’s sixth annual Carbon Market Survey, ran from 27 January to 14 February 2011. The survey garnered 2,535 responses from 101 countries. The report provides the most comprehensive overview of the international carbon market to date. It is based on Thomson Reuters Point Carbon’s databases and market intelligence, together with the world’s largest survey on the carbon market. Questions were asked about current behaviour and future expectations in the areas of the EU ETS, CDM, JI, AAU, RGGI, North American offsets, future emissions trading schemes around the world and, of course, international climate negotiations.

- Among the respondents, 1,064 or 43% stated that they were involved in trading various compliance carbon allowances and credits, or owned such carbon instruments.

- The Kyoto Protocol to the United Nations Framework Convention on Climate Change (UNFCCC), which entered into force in February 2005, resulted in the launch of the EU’s Emissions Trading Scheme (ETS). The EU ETS is the world’s first international greenhouse gas emissions trading scheme. It works on a cap-and-trade basis, where the total allocation is set at the start of a trading period. EU Allowances (EUAs) are the tradable units under the EU ETS. Up to a certain limit, companies regulated by the EU ETS are also allowed to import carbon permits from third countries (CERs and ERUs).

- Certified Emissions Reductions (CERs) are project credits generated from emission reduction countries in developing countries.

Source: Point Carbon Press Release dated March 1, 2011.