About the Author:

Philippine de T’Serclaes, a French national, is an analyst at the IEA specializing on financing issues. She has published two books and numerous papers analyzing policies and measures to overcome market barriers to energy efficiency projects – with a focus on the building sector. Her area of expertise also deals with the analysis and elaboration of financial mechanisms for clean technology projects in major emerging economies; linkages between carbon finance and energy efficiency investments; and how these feed in to post-2012 frameworks.

This information paper was prepared for the Energy Efficiency Working Party. It was drafted by the Energy Efficiency and Environment Division, the Energy Efficiency Unit. This paper reflects the views of the International Energy Agency (IEA) Secretariat, but does not necessarily reflect those of individual IEA member countries.

The report was written by Philippine de T’Serclaes, Senior Finance Policy Analyst in the Energy Efficiency and Environment Division of the IEA, under the supervision, mentoring and creative support of Dr. Nigel Jollands, Head of the Energy Efficiency Unit, and Dr. Richard Bradley, Head of the Energy Efficiency and Environment Division of the IEA.

Here, ThinktoSustain.com is presenting the Executive Summary of the paper…

Executive Summary

Scaling-up investment in energy efficiency is essential to achieving a sustainable energy future. Despite energy efficiency’s recognized advantages as a bankable investment with immense climate change mitigation benefits, most of the energy efficiency (EE) potential remains untapped and the investment gap to achieve climate goals is tremendous. This report seeks to improve understanding as to why this is so, and what can be done about it.

Governments are committing large sums of money towards the mitigation of greenhouse gases through energy efficiency, but these are not nearly sufficient to address the EE investment gap. The Clean Technology Fund (CTF), for instance, provides a one-time infusion of USD 4.9 billion[1] towards emissions mitigation. However, these public investments are small compared with the projected investment needs – over USD 299.4 billion per year up to 2030 to reach the 450 scenario.[2] The United Nations Framework Convention on Climate Change (UNFCCC) estimates that over 86% of those investments should be covered through private investments. To date, however, private investment levels remain low. The Clean Development Mechanism (CDM) for instance – the official UNFCCC recognized channel for private investments in emerging economies’ clean energy – amounted to only USD 67 billion of investments over a ten-year period – among which USD 7.6 billion went to energy efficiency projects (UNEP/Risoe, 2010). This is equivalent to an average USD 760 million yearly, which is far from the estimated annual needs of USD 299.4 billion.

This study analyses the barriers to scaling-up private investments in energy efficiency and recommends concrete policies that can help close the EE investment gap by involving the private sector. The report focuses on barriers faced by investors and project developers looking to finance EE projects. More specifically, it analyses the impact of risks – actual and perceived – associated with EE projects. Much has been written about the many barriers to energy-efficiency investments, including market organization, price distortions, split incentives, lack of information, transaction costs, institutional biases, product availability, regulatory policy, and others.[3] This report does not delve into the full array of these barriers. Instead, it focuses on the financial and risk barriers.

The IEA undertook this study because there is relatively little literature that analyses the observed EE investment gap from a risk perception framework. For example, Financing Energy Efficiency (Taylor et al., 2008) provides an extensive treatment of suggested policies and structures in place to facilitate the financing of EE projects. However, there is little treatment of how the risks perceived to be associated with energy efficiency projects affect investment decisions, or why current mechanisms fail to address risk perception in project selection.

We hope this report contributes to unraveling the riddle of unrealized EE potential. Our short-hand for thinking about the problem forms the title to this report: does only money matter, or are there other factors affecting the apparent shortfall in EE investment? Key research questions posed include:

- How should public money be spent not only to maximize energy efficiency but also to trigger sustainable private-sector investment in energy efficiency?

- Do the low levels of EE investment result from a lack of financing, or is more complex decision-making behaviour at play?

- What do business and asset owners (and households) really consider in deciding whether or not to invest in an energy efficiency asset with apparently high returns?

- Observed incongruity between paper assessment and physical results raises the question of whether EE investments are about more money – public or private – being made available or whether other factors such as risk perception and project complexity are at play.

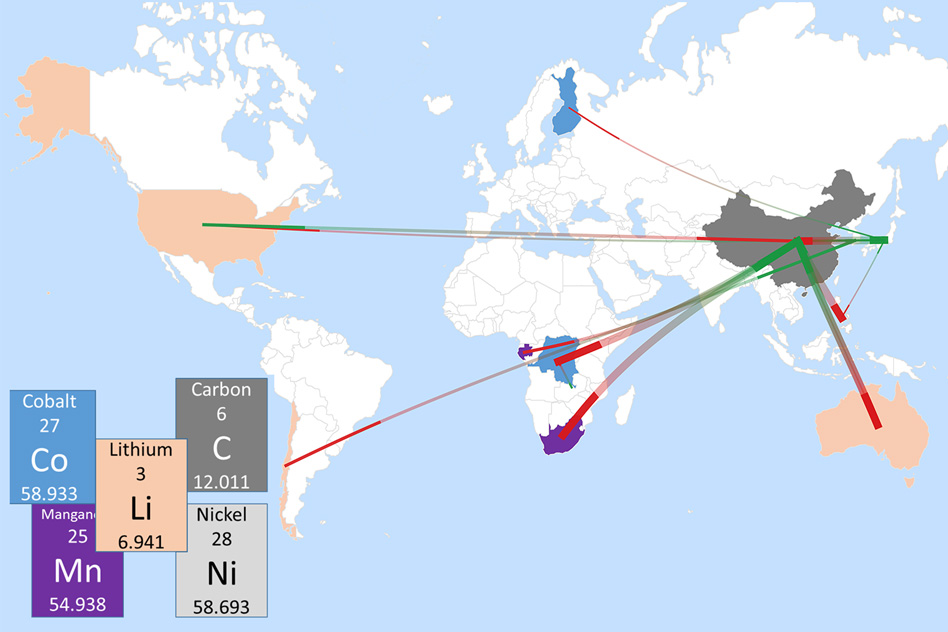

Evidence from this study suggests that targeting risk perception of investors through financial and other instruments could lead to scaled-up EE investments. We focus on emerging economies because most of the new EE investments required will be in China, India, and other emerging G20 countries. However, the investment barriers analyzed and the policies recommended apply to both the developed and the developing world.